As we entered the new year, a lot of you probably think that by now, you should have already achieved your dream car or dream house.

By now, you've certainly fantasized about that independent lifestyle and when you're going to achieve that status at this point. You've certainly said to yourself that you would've attained something at a certain age or stage in your life.

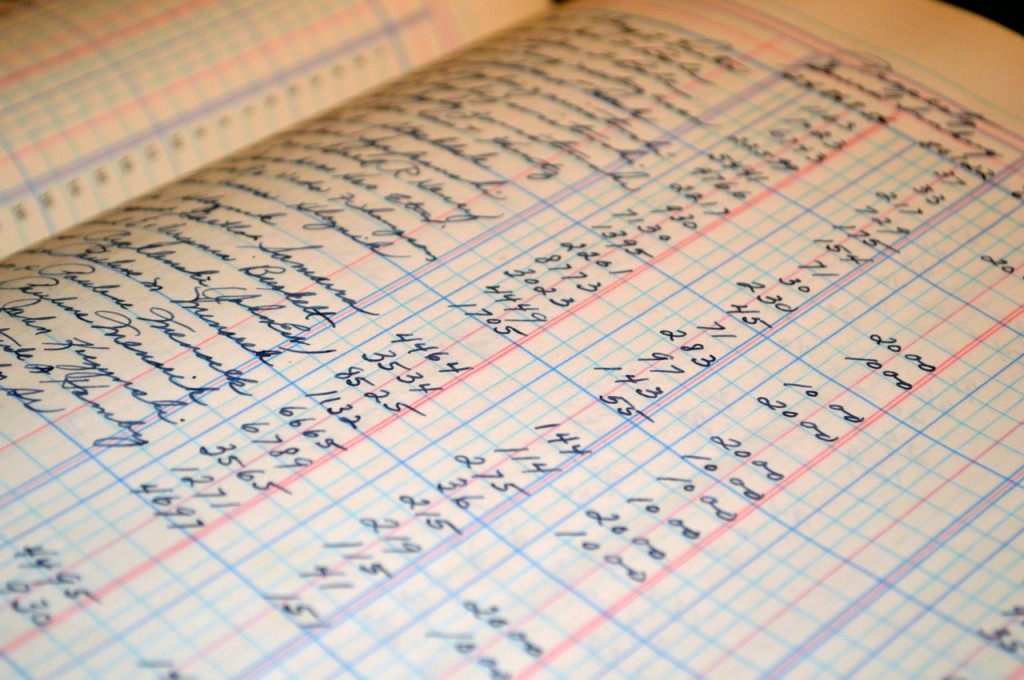

Photo courtesy of Pixabay via Pexels

Photo courtesy of Pixabay via Pexels

Despite having the liquidity to purchase some of those items you want, it is still better to split them into parts than to pay them as whole to keep your funds on track and to have that nice cash flow that could pay for your other wants and needs. This way, you're sure on your way toward achieving financial stability.

Usually, when this happens, it is almost a common practice to apply for a loan or credit from financial institutions. This gives you more financial flexibility when you only have to pay the bank or lending companies in installments, plus interest depending on which bank you approach. Sound convenient?

While all of this sounds easy and ideal way to be granted the loan you're applying for, you still have to pass a credit investigation to even qualify for one. The one thing that you need to pass the investigation with is to have a very good credit score. Now if you're applying for a loan for the first time, this is what you need to know about credit scores and how to boost your credit score to get that approval.

What exactly is a credit score?

Photo courtesy of energepic.com via Pexels

Photo courtesy of energepic.com via Pexels

A credit score is a number that is used in certain countries that aim to predict your chances of meeting financial obligations, such as paying back a loan. The higher your score, the easier is your access to various financial services and credit options and as well as faster approval for your application to them. It opens a lot of doors for borrowers to different loan opportunities, from financial institutions to credit applications, and boosts their chances of approval.

On the other hand, many countries still don't use the credit score system. If they do, many don't adhere to the system being used in the US and Canada, which is Fair Isaac Corporation (FICO). While here in the Philippines, the one who handles credit scoring is the Credit Information Corporation (CIC). However, there is no centralized credit reporting just like in the US, but that doesn't mean that you shouldn't watch out for your score or even learn how to improve your credit score for that matter.

Banks nowadays tend to take a look at your transactions and bank statements as well as if you're meeting payments; thus, summarizing more or less what your credit score is.

What makes up a good credit score in the Philippines?

Now that you know what a credit score is, the next question you have in mind is what makes up good credit and how you can build up your credit score. Here are five factors that determine your credit score, which include the following:

- History of payments

Photo courtesy of Pixabay via Pexels

Photo courtesy of Pixabay via Pexels

This makes 35% of the overall scoring. Making your payments on time is a massive factor in computing your credit score. You should prevent from having 30-day delinquency that could cause your score to drop as much as 90 to 110 points from a 780-point consumer who has never missed a payment before.

- Number of debt

This takes 30% of the overall scoring. This category takes into account how much you owe across all your credit accounts, including your credit utilization ratio.

- Credit history duration

Photo courtesy of Negative Space via Pexels

Photo courtesy of Negative Space via Pexels

The length of your credit history makes up 15% in the deciding factor. The ages of your first credit card, your new credit card account, and the average of all of them are included as well.

- Credit mix

The credit mix, which refers to the different types of credit that you have, is 10% of the deciding factor. Believe it or not, maintaining various kinds of credit accounts simultaneously, such as credit cards, installment loans, car loans, and condo dues (e.g., DMCI Homes), can improve your score.

- New credit

Applying for a new credit account receives 10% in the deciding factor. Getting a new credit account or loan triggers a "hard inquiry," which dings your score, which means, opening multiple lines of credit in a short period can affect your rating.

So what kind of score is considered a good credit score in the Philippines?

Believe it or not, if you have a 750 and above score, then you have an excellent credit score. A range of 700-749 means you have good credit standing, 650-699 is fair, while 600-649 is poor. Scores that rank below 600 are already considered as a bad credit score.

Credit scores in the Philippines

The Philippines has a government-owned and controlled corporation (GOCC) that collects credit information from various sources such as banks, financial institutions, insurance companies, financing firms, credit cooperatives, utility companies, and other establishments that offer loans. The CIC collects all the information of a potential borrower to help creditors evaluate their ability to pay.

Moreover, given the current situation of the credit information exchange system in the Philippines, only individuals with credit records or transactions to financial institutions involved in credit-related activities are entitled to avail of their credit reports and scores. This is why if you’re new to keeping tabs of your credit score, you should be wary if you’re making payments on time or not.

Photo courtesy of bruce mars via Pexels

Photo courtesy of bruce mars via Pexels

It’s crucial to keep your score high to have more opportunities to loan and be approved for higher amounts. If you’re thinking of working to improve your score, here are a few things you’ll need to do:

- Pay credit dues on time.

- Spend within your credit card limit.

- Build a good credit history early.

- Mix things up.

- Have two credit cards.

- Don’t apply for credit cards and loans simultaneously.

- Plan your loan and credit card inquiries on a focused time.

- Request a raise on your credit limit.

- Pay your bills and rent on time.

Now that you've learned about credit score, it would be best if you would prevent yourself from spiraling credit rises. Make sure you know how to manage your finances properly and that you always monitor every detail to live peacefully and by taking steps towards financial freedom.