Investing in a pre-selling condo property in today’s post-pandemic world might seem like a bad idea at first glance. But as the whole world settles into a new normal, buyers and developers alike are seeing early sale condominiums as the new frontier for recovery in the Philippine real estate market today.

As experts gain more insights into the impacts of the global pandemic on condo lessors, and real estate in general, they’re also starting to see how pre-selling condos in the Philippines might serve as attractive opportunities for long-term investors.

Based on the Colliers property market report for the Philippines, early sale and rent-to-own (RTO) properties and residential units will likely be the most lucrative types of condominiums in the Philippines over the next few years.

Savvy buyers should get on board this potential property choice today, if they really want to reap the benefits of a presale unit in current market conditions. Discover all the premier choices you can make for a long-term investment when you check out what’s pre-selling with DMCI Homes Leasing today.

Keep on reading this guide to find all the tips, trends, and future forecasts you need for your early sale condo journey this year.

Photo courtesy of Max Rahubovskiy via Pexels

Photo courtesy of Max Rahubovskiy via Pexels

Benefits of a pre-selling condo

When it comes to choosing the right type of real estate for your investment needs, it’s helpful to know the pros and cons of pre-selling condo properties and other similar investment options. The benefits, for example, of an early or pre-sale sale condo unit include:

- Low introductory prices

Early sale units tend to have lower introductory prices for buyers than ready-for-occupancy (RFO) condo units. This is meant to attract early investors and provide more options for them as they invest in a condo development for a longer period of time. - Flexible payment schemes

These types of condominiums also offer more flexible payment schemes than fully developed properties. Payments for early sale units are more spread out over time, allowing for flexibility for buyers to explore schemes like rent-to-own (RTO) and other payment schedules. - More funding to complete the project

For developers, these types of units are important because they provide them with more funding to complete a condo project. With added support from early investors and buyers, they can ensure the completion of a well-designed development with a smooth condo turnover for the whole community.

All these benefits serve the needs of developers and buyers alike. Given the positive impact these early selling projects provide, investors like you can discover more about the state of pre-selling condos in the Philippines with a quick market overview.

Photo courtesy of Max Rahubovskiy via Pexels

Photo courtesy of Max Rahubovskiy via Pexels

Market overview of pre-selling condos in the Philippines

To make an informed decision for your long-term real estate investment, it’s crucial that you understand the market you’re moving into in the Philippine economic and real estate progress today.

Check out this quick overview of the local pre-selling condo market, its trends over the last five years, and its general supply and demand history so far:

- The state of the local pre-selling condo market - According to a landmark study by Colliers, the Philippine presale market finished 2022 on a high note and is persistently recovering throughout 2023, backed by high supply and demand for early sale unit developments in Metro Manila right now.

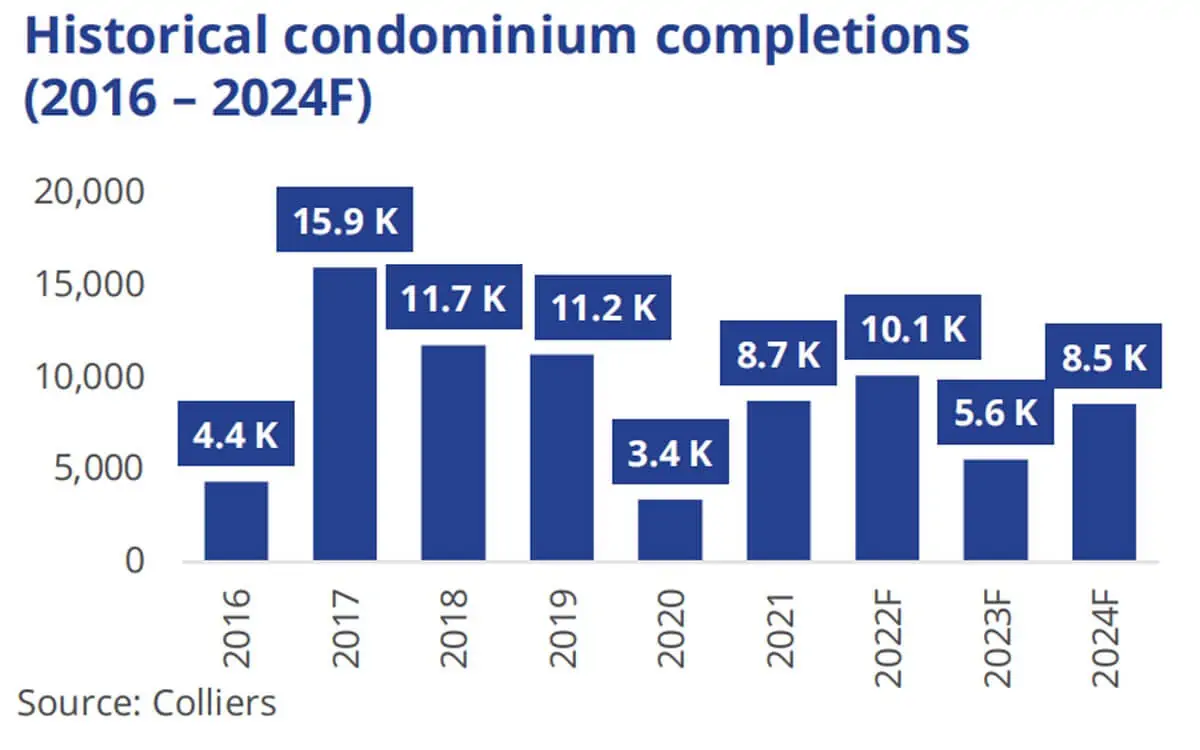

- Condominium completion trends from the last few years - Historical data, provided in the figure below, has shown that the popularity of pre-selling condo completions has fluctuated over the past few years. Whether due to the impact of COVID-19 on local real estate or not, the aforementioned Colliers study also surmises that the current trend of buying these types of luxury and ultra-luxury projects might drive even more condo completions, as investors bank on these projects’ potential for capital appreciation.

Figure 1. Condominium completions over the past eight years

Figure 1. Condominium completions over the past eight years

Photo courtesy of Colliers - Increase in supply and demand - According to the researchers at Colliers, the local real estate industry is experiencing an annual average completion of 8,100 units between 2022 to 2024, versus the 7,800 units completed yearly from 2019 to 2021. That supply increase, along with a pick-up in demand for presale properties in Metro Manila, resulted in about 14,900 units being sold in the capital within the first nine months of 2022 - thus outpacing a full year of sales in 2021 of just 12,400 units.

All these trends and analyses just go to show that the outlook for the Philippines’ presale market is pretty hopeful. Given the hopeful state of the property market, it’s highly likely that the success rates for early purchase condominiums will remain resilient, even amid external factors like rising mortgage rates and higher costs of living.

It is with these hopeful signs that people are finding more and more reasons to invest in early sale developments for their long-term real estate needs.

Photo courtesy of Max Rahubovskiy via Pexels

Photo courtesy of Max Rahubovskiy via Pexels

What affects pre-selling condominiums in the Philippines?

Aside from rising mortgage rates and other real estate industry factors, what are some other pressing external factors that might have an affect on the completion of pre-selling condominiums in the Philippines today? Here are some few key real estate factors to look out for as a real estate investor right now:

- Economic factors - The overall health of a local economy is a key factor that can majorly affect the value of any kind of real estate. When economic indicators like the local GDP, employment rate, price of goods and services, and more are unhealthy, then so are the values of real estate properties like early sale condos.

- Political factors - Local politics and legislation are another set of factors that can have a huge impact on property prices and buyer demand. It’s important to be aware of government legislation on real property tax (RPT), credits, and subsidies because they can help you determine the viability of longer-term investments into property.

Photo courtesy of Max Rahubovski via Pexels

Photo courtesy of Max Rahubovski via Pexels - Demographics - This factor refers to the data and statistics that help to describe a local population, like a generation of real estate investors. Major shifts in demographics like age can have a huge impact on property investment trends for decades to come; property buying trends for the Gen Z demographic, for example, vary wildly from the trends of older generations like Gen X or Gen Y.

- Environmental factors - The environment is a major player in the success (or failure) of any early sale condominium development. Natural disasters like earthquakes, for example, can massively diminish the progress or popularity of certain properties, and even affect the prices of units within the development as well.

- Global crises and conflicts - The last few factors that can massively affect early sale properties in the Philippines today are crises and conflicts on an international scale. Events like global pandemics, wars, and economic crises can directly affect the development of your early purchase unit, especially in worst case scenarios like wide-scale destruction. This is why it’s important to keep an eye out for these global crises and conflicts when considering your long-term presale property investment.

Photo courtesy of Max Rahubovskiy via Pexels

Photo courtesy of Max Rahubovskiy via Pexels

Future forecasts for pre-selling with DMCI Homes

There’s a lot to keep in mind when it comes to a smart investment in a condo that’s pre-selling with DMCI Homes Leasing. There are the aforementioned benefits behind early sale units, the current state of the local presale market, and all previously mentioned factors to look out for as the world grows beyond the COVID-19 pandemic today.

In light of everything that you’ve learned so far, it’s finally time for you to discover the presale condo market’s outlook, predictions, and emerging trends for your real estate decision-making this year. Keep on reading to learn more.

Photo courtesy of Max Rahubovskiy via Pexels

Photo courtesy of Max Rahubovskiy via Pexels

Market outlook and predictions

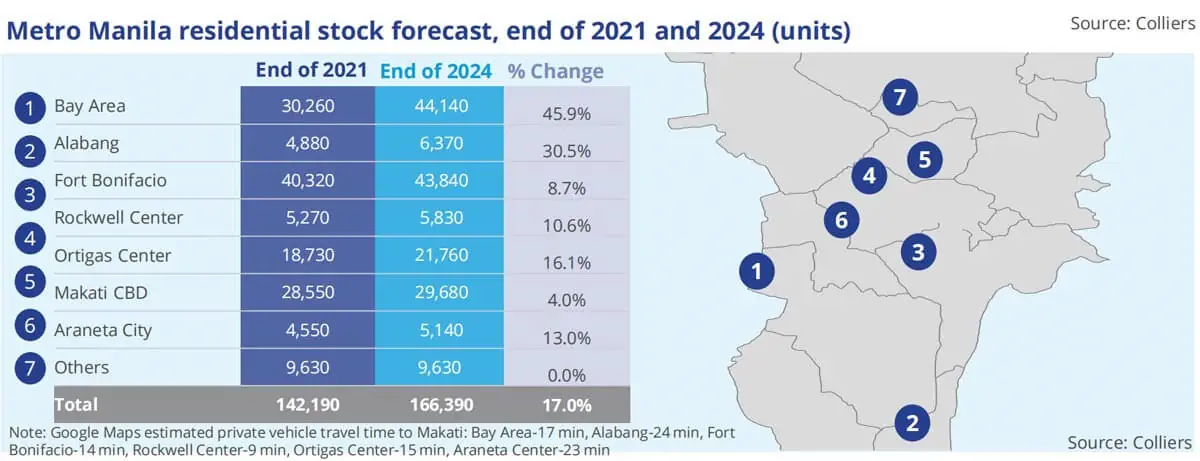

The general outlook for pre-selling properties is pretty positive. Colliers’ landmark research into Philippine real estate predicts the delivery of 5,600 new condominium units within 2023 alone.

The same study also shows that, by the end of 2024, residential condominium supply in big Metro Manila business districts will reach 166,400 units - which is a remarkably high 17% increase from 142,200 units in 2021.

Figure 2. Residential stock forecast, end of 2021 and 2024

Figure 2. Residential stock forecast, end of 2021 and 2024

Photo courtesy of Colliers

This residential stock forecast will most likely be buoyed by the interest of buyers like expatriates and local employees, who will be looking for early purchase housing units near workplaces in the bustling metro.

As the Metro Manila early sale condominium market recovers, Colliers' research recommends that developers jump on several emerging buyer trends - all of which will be discussed in detail in the next section.

Photo courtesy of Tom Fisk via Pexels

Photo courtesy of Tom Fisk via Pexels

Emerging trends in the pre-selling condo market

Emerging trends for pre-selling refers to buyer interests that developers are taking advantage of as they open more and more properties in today’s thriving buyer's market.

Some popular and emergent trends include things like:

- Open spaces and green building certifications - Open spaces, green condo life, and green building certifications have become crucial needs for property buyers over the past few years, due to the impacts of the COVID-19 lockdowns in 2020. With certified innovations like the Lumiventt® Design Technology, DMCI Homes Leasing ensures the eco-friendliness and sustainability of its properties for the many years to come.

- Homes that support the hybrid work model - Another emergent trend that you might be interested in as a buyer is the development of the hybrid or work-from-home (WFH) setup. Studies have shown an increased demand for home offices in condos, due to the popularity of hybrid work brought about by pandemic lockdowns. Pre-selling condos can be designed with the WFH model in mind through accessible co-working spaces and other similar work amenities.

Photo courtesy of Tom Fisk via Pexels

Photo courtesy of Tom Fisk via Pexels - Transit-oriented development - One trend you might be looking forward to as a buyer is the presale of transit-oriented developments near accessible public transport systems. The highly anticipated completion of infrastructure projects like the LRT-1 and 2 extensions, the MRT-4 and 7, and other provincial transport systems have resulted in more buyers looking for early sale units in less congested locations. With a transit-oriented development, potential buyers can benefit from living in accessible but uncongested homes all across the metro and its surrounding provinces today.

- Locations beyond the metro - As you might’ve guessed from the previously listed trend, early purchase condos in locations beyond the center of the metro are now rising in both popularity and prevalence. Properties in less congested cities like Caloocan offer investor-friendly opportunities for buyers and renters alike, allowing you to beat other buyers to the punch for great home locations - even outside of the overly congested central cities of urban Metro Manila.

Photo courtesy of Tom Fisk via Pexels

Photo courtesy of Tom Fisk via Pexels

The next five years

Whether you're thinking of buying or renting a condo home, you have to understand the implications of such a huge financial investment as soon as five years in advance. Given this major purchase, it's good to have a background on the forecasts, outlooks, and future trends of your selected market: the ever-hopeful presale market in today’s Philippine real estate industry.

So remember to start researching your options as soon as now, and to start saving up for your investment as well. Start thinking about ways to earn more, to lessen your debt, and to calculate your condo’s return on investment, in order to prepare for your purchase over the next five years.

Photo courtesy of RODNAE Productions via Pexels

Photo courtesy of RODNAE Productions via Pexels

Pre-sell meaning recovery in a post-COVID world

As Joey Roi Bondoc, the Associate Director for Research at Colliers, said in light of their landmark property sector research:

“Philippine property is undeniably on its way to recovery. Lessons from COVID disruptions should propel the market to greater heights. Now is the right time to focus on innovation and differentiation-led recovery strategies, especially as developers and investors continue to face a precarious global economic and political environment.”

The outlook for the Philippine real estate industry is bright and hopeful. While there are still tons of factors that contribute to its fluctuation, sectors like the pre-selling condo market continue to drive excellent opportunities for recovery for real estate investors in the Philippines today.

Hopefully, this rundown of trends, forecasts, and market predictions will better inform you in your decision-making process for your future presale investment. Whether or not you go for a presale or RFO condo, you can be assured that you’re investing in premium high-quality communities with DMCI Homes Leasing this year.

Photo courtesy of RODNAE Productions via Pexels

Photo courtesy of RODNAE Productions via Pexels

Key takeaways

Reap the benefits of a pre-selling property investment in a hopeful real estate market with DMCI Homes Leasing today. Bring these final takeaways with you as you learn more about your options for a great purchase this year:

- Invest early. By going for an early sale property, you get to enjoy an early investment into a unit that’ll return more benefits to you over a longer period of time.

- Anticipate all factors. Always remember to keep an eye out for economic, environmental, and global risk factors that might affect the quality of your investment in the near future.

- Futureproof your purchase. Go for developments that keep future trends in mind so that you can be assured of a future-proofed home for your long-term comfort and security.

Want more insights into real estate trends and forecasts? Stay up-to-date with DMCI Homes Leasing condo options by checking out our social media accounts now: Facebook, Twitter, Instagram, and YouTube.